- #Lift equifax security freeze online full

- #Lift equifax security freeze online password

- #Lift equifax security freeze online free

So should anyone who has had their mail stolen or otherwise had their personal or account information revealed.

#Lift equifax security freeze online free

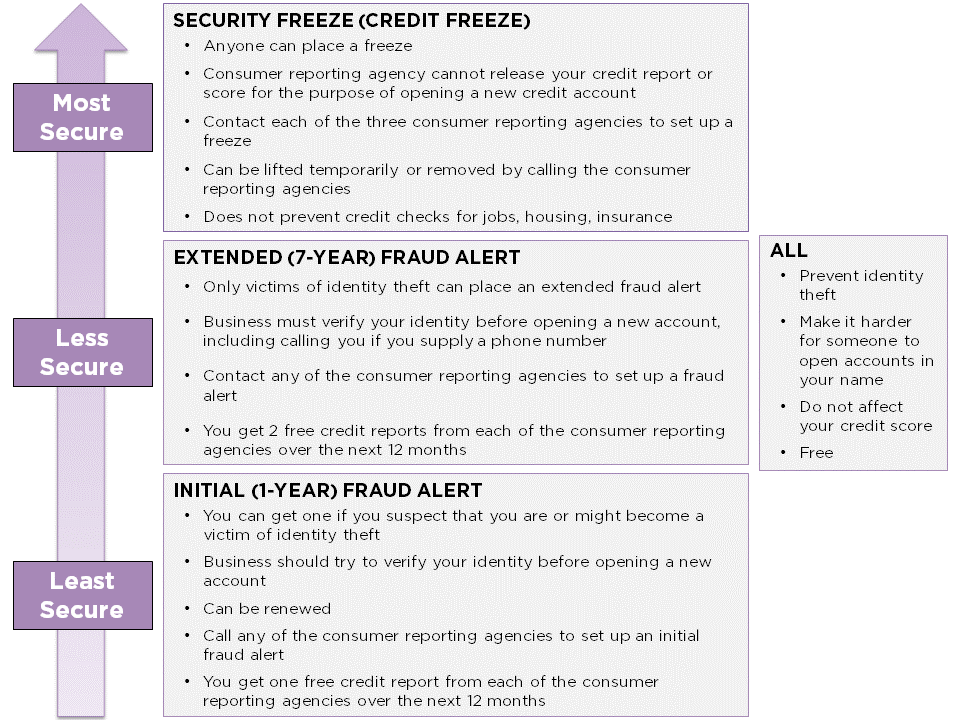

21, 2018, placing, lifting and removing a freeze is now free for all consumers, so cost is no longer a factor in the decision-making process.)Īnyone can place a security freeze, but consumers whose Social Security number has been revealed unintentionally-through a company “security breach” or a lost wallet, for example-should seriously consider it as a precaution. (With the implementation of a new law on Sept.

When making a decision about placing a security freeze, consider the likelihood that you will become a fraud victim, the extent to which the freeze would delay important transactions, and whether the extra peace of mind is worth the extra effort.

Even though lifting the freeze shouldn’t take more than an hour, that could still be too slow if you’re trying to get “instant credit” from a merchant at the time of your purchase.Whenever you want someone who is locked out to have access to your credit report or score, you must temporarily lift the freeze (or remove it permanently).

#Lift equifax security freeze online full

If you’re married, that means six freezes for full protection.

#Lift equifax security freeze online password

This is easily done with the personal identification number (PIN) or username and password used to access your account and manage your freeze.Ī security freeze will not keep out anyone with whom you already have an account or other business relationship. You have the right to lift the freeze as needed, before applying for credit or giving anyone else permission to check your credit report or score. That’s a good thing if a crook is trying to access your credit.ĭepending on credit bureau policy, your credit file may also be inaccessible to others who use it in their decision-making process, such as insurance companies, landlords, employers who need to do a background check, cell phone companies and utilities. This usually means the credit request will be denied. If you are creditworthy, it means you are someone the business wants to lend money to.Ĭreditors who are denied access to an applicant’s credit file can’t evaluate the borrower’s credit history. The creditor uses this information to determine if the applicant is creditworthy. These businesses compile information about your credit accounts and payment history from businesses that have lent you money. In the typical credit application process, a creditor will request the applicant’s credit report or credit score from one of the nation’s three major credit reporting agencies (also known as credit bureaus): Equifax, Experian and TransUnion. This means that new credit cannot be established in your name until you lift the “security freeze.” What is a security freeze?Ī security freeze prevents anyone from opening new credit accounts in your name by making your credit file off-limits to prospective creditors-and crooks. To avoid ID theft, you must take steps to protect yourself. When their crime is discovered, the crooks move on, leaving their victims to deal with the fraudulent debts. In many cases, they open new credit accounts in someone else’s name. ID theft is a growing crime in which thieves use stolen personal information, such as a Social Security number, to impersonate their victims. consumers become victims of identity theft.

0 kommentar(er)

0 kommentar(er)